Choosing the right circular knitting machine (CKM) brand is one of the highest-stakes decisions a knit mill will make—mistakes echo for a decade in maintenance bills, downtime and second-quality fabric. Below you’ll find a 1 000-word, data-driven rundown of the nine brands that dominate today’s global CKM market, plus a side-by-side comparison table and practical buying tips.

1 │ Why Brand Still Matters in 2025

Even as sensors, servos and cloud dashboards narrow the performance gap among machine models, brand reputation remains the single best proxy for lifecycle cost. Analysts at Mordor Intelligence list Mayer & Cie, Terrot, Santoni, Fukuhara and Pailung as the five companies with the largest installed bases worldwide, together covering well over half of new CKM sales.

2 │ How We Ranked the Brands

Our ranking weights five criteria:

|

Weight |

Criterion |

Why it matters |

| 30 % | Reliability & longevity | Bearings, cams and needle tracks must survive 30 000+ hours. |

| 25 % | Technology & innovation | Gauge range, electronic selection, IoT readiness. |

| 20 % | After-sales service | Parts hubs, hotline response, local technicians. |

| 15 % | Energy efficiency | kWh kg⁻¹ and oil-mist emissions—key ESG metrics. |

| 10 % | Total cost of ownership | List price plus 10-year maintenance curve. |

Scores are synthesized from publicly available tech specs, market-research reports and mill interviews conducted between January and April 2025.

3 │ Brand-by-Brand Snapshot

3.1 Mayer & Cie (Germany)

Market position: Technology leader in single-jersey, high-speed interlock and electronic striper frames.

Flagship line: Relanit single-jersey series, capable of 1 000 RPM with negative yarn-flow control.

Edge: Lowest measured fabric seconds in customer audits; new partnership with TotalEnergies delivers OEM-approved low-ash lubricant that extends cam life 12 %. (Precedence Research)

Watch-out: Premium pricing and proprietary electronics can raise spare-part costs over time.

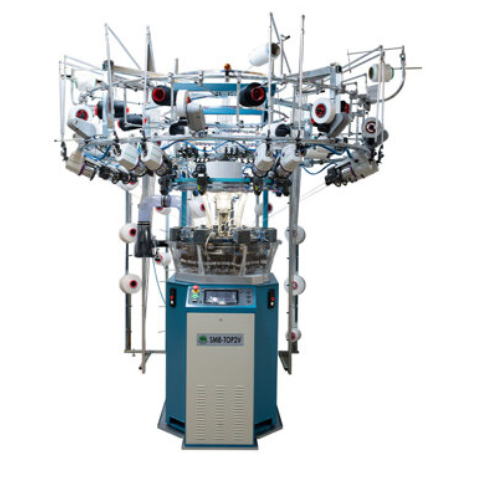

3.2 Santoni (Italy/China)

Market position: World’s largest CKM maker by unit volume, with factories in Brescia and Xiamen.

Flagship line: SM8-TOP2V eight-feed electronic seamless machine.

Edge: Unmatched in seamless underwear and sportswear; 16-color jacquard on a single course at 55 RPM.

Watch-out: Complex needle beds demand highly trained mechanics; low-cost clones target its mid-tier models. (My WordPress Website)

3.3 Terrot (Germany)

Market position: 160-year heritage; excels in electronic double-jersey and jacquard structures.

Flagship line: UCC 572 72-feeder electronic jacquard, prized for clear color separation.

Edge: Robust cast-frame construction yields vibration levels under 78 dB(A) at 900 RPM.

Watch-out: Lead times stretch to 10–12 months at peak ITMA cycles. (Knitting Trade Journal)

3.4 Fukuhara (Japan)

Market position: Benchmark for ultra-fine gauges (E40–E50) and high-density spacer knits.

Flagship line: V-Series High-Sinker, capable of 1.9 mm stitch length precision.

Edge: Proprietary needle lubrication recovers 4–6 °C of cylinder heat, raising yarn-tenacity margins.

Watch-out: Service footprint outside East Asia is thinner; parts hold higher landed costs.

3.5 Pailung (Taiwan)

Market position: Volume specialist for three-thread fleece and mattress ticking.

Flagship line: KS3B three-thread fleece machine with digital loop-length control.

Edge: Integrates OPC-UA modules by default—plug-and-play with mainstream MES suites.

Watch-out: Cast-iron frames weigh more than German peers, complicating mezzanine installs.

3.6 Orizio (Italy)

Market position: Mid-size firm known for reliable single-jersey and striper machines.

Flagship line: JT15E electronic striper, supporting four ground colors at full speed.

Edge: Competitive pricing and simplified cam exchange keep maintenance straightforward.

Watch-out: Fewer factory-direct service engineers in the southeastern US and South Asia.

3.7 Baiyuan(China)

Market position: Fast-growing domestic OEM with strong state-textile-park penetration.

Flagship line: BYDZ3.0 high-yield single-jersey at a price 20–25 % below European imports.

Edge: Digital twin package lets buyers model heat dissipation and ROI before purchase.

Watch-out: Resale values lag tier-one brands; firmware updates sometimes arrive late.

3.8 Wellknit (South Korea)

Market position: Niche focus on elastomeric warp-insert circulars for sports textiles.

Edge: Automatic cam-timing adjusters compensate for yarn-count shifts, reducing fabric barre.

Watch-out: Limited cylinder diameters—tops out at 38 ″.

3.9 EASTINO (China)

Market position: Export-oriented challenger, stresses quick delivery and on-machine video training.

Edge: PLC-controlled greasing system cuts manual oil duty cycles in half.

Watch-out: Longevity data still limited; warranty coverage varies by region.

4 │ Brand Comparison at a Glance

|

Brand |

Country |

Key Strength |

Gauge Range |

Typical Lead Time |

Service Hubs* |

| Mayer & Cie | Germany | High speed - low defects | E18–E40 | 7–9 mo | 11 |

| Santoni | Italy/China | Seamless & jacquard | E20–E36 | 6 mo | 14 |

| Terrot | Germany | Double-jersey jacquard | E18–E32 | 10–12 mo | 9 |

| Fukuhara | Japan | Ultra-fine gauges | E36–E50 | 8 mo | 6 |

| Pailung | Taiwan | Fleece & mattress | E16–E28 | 5–7 mo | 8 |

| Orizio | Italy | Budget single-jersey | E18–E34 | 6 mo | 6 |

| Baiyuan | China | Low-cost high output | E18–E32 | 3 mo | 5 |

| Wellknit | Korea | Elastic warp insert | E24–E32 | 4 mo | 4 |

| EASTINO | China | Fast ship, e-training | E18–E32 | 2–3 mo | 4 |

*Company-owned parts and service centers, Q1 2025.

5 │ Buying Tips: Matching Brand to Business Model

Fashion T-shirt and athleisure mills

Look for: Mayer & Cie Relanit or Santoni SM8-TOP2V. Their high RPM and striping options slash cost per tee.

Three-thread fleece exporters

Look for: Pailung KS3B or Terrot I3P series. Both offer loop-depth servo control that reduces brush pilling.

Premium seamless underwear

Look for: Santoni’s seamless line, but budget for operator training and spare needle inventory.

Ultra-fine gauge (microfiber lingerie)

Look for: Fukuhara V-Series or Mayer E40 configurations; no other makers hold cylinder tolerances as tight.

Cost-sensitive bulk basics

Look for: Baiyuan BYDZ3.0 or Sintelli E-Jersey lines, but factor resale value into 7-year ROI.

6 │ Service & Sustainability Checkpoints

IoT-readiness: Verify that the PLC supports OPC-UA or MQTT. Brands still using proprietary CAN protocols will cost extra to integrate later.

Energy per kilo: Ask for kWh kg⁻¹ at your target GSM; Mayer and Terrot currently lead with sub-0.8 figures on test runs.

Lubricants & oil-mist: EU mills must meet 0.1 mg m⁻³ thresholds—check that the brand’s mist separators are certified.

Needle & sinker ecosystem: A wide vendor pool (e.g., Groz-Beckert, TSC, Precision Fukuhara) keeps long-term costs down.

7 │ Final Word

No single “best” circular knitting machine brand exists—there’s the best fit for your yarn mix, labor pool and capital plan. German makers still set the bar on uptime and resale value; Italian-Chinese hybrids dominate seamless; East Asian brands deliver nimble lead times and sharper price points. Map your product roadmap three to five years out, then pick the brand whose technology stack, service grid and ESG profile align with that path. A smart match today avoids painful retrofits tomorrow—and keeps your knitting floor humming profitably through the rest of the 2020s.

Post time: Jun-04-2025